At Bermuda Credit Union, we are always striving to improve the service and support we provide to you, our valued Members.

To ensure our team is continually trained and equipped to serve you better, we will be closing early once a month for staff training and team building.

Starting August 19, 2025, our branches will close at 3:00 pm on the third Tuesday of every month.

This dedicated time allows our staff to develop skills, strengthen teamwork, and stay up to date on best practices -so we can deliver even better service to you.

We appreciate your understanding and support as we invest in our team to serve you better.

Thank you for being a valued member of the Bermuda Credit Union.

Management

Membership is ownership at BCU -

where finance meets community.

the things you need

open an account or speak with a loans officer.

Personal service online, in-person or by phone!

for all the unexpected

all those who love...

make it a bit easier for those left behind.

We are a member-owned, not-for-profit, cooperative financial institution offering a full range of financial products and services to the Bermuda community.

From accessible loans to high-yield savings and insurance products, we have the tools you need to manage your money.

Savings Accounts

Apply for a Loan

Plan & Insure

Help & FAQs

Savings Accounts

Apply for a Loan

Help & FAQs

Plan & Insure

Important Update

Monthly Closure for Staff Training

Dear Members,

At Bermuda Credit Union, we are always striving to improve the service and support we provide to you, our valued Members.

To ensure our team is continually trained and equipped to serve you better, we will be closing early once a month for staff training and team building.

Starting August 19, 2025, our branches will close at 3:00 pm on the third Tuesday of every month.

This dedicated time allows our staff to develop skills, strengthen teamwork, and stay up to date on best practices -so we can deliver even better service to you.

We appreciate your understanding and support as we invest in our team to serve you better.

Thank you for being a valued member of the Bermuda Credit Union.

Management

Being a member has many benefits.

At a credit union, every customer is also a member and part-owner. In addition to access to our financial products and services, you’ll have a say in important credit union decisions.

Join Bermuda Credit Union today and become part of a financial cooperative of members with a strong common bond and shared goals of empowering our community.

Frequently Used Services

A simple and convenient way to build savings, repay loans, or set some of your wages aside automatically.

Nothing is impossible. We can help you achieve your goals!

With Payroll Deductions, you can ask your employer to send a portion of your salary directly into your credit union account.

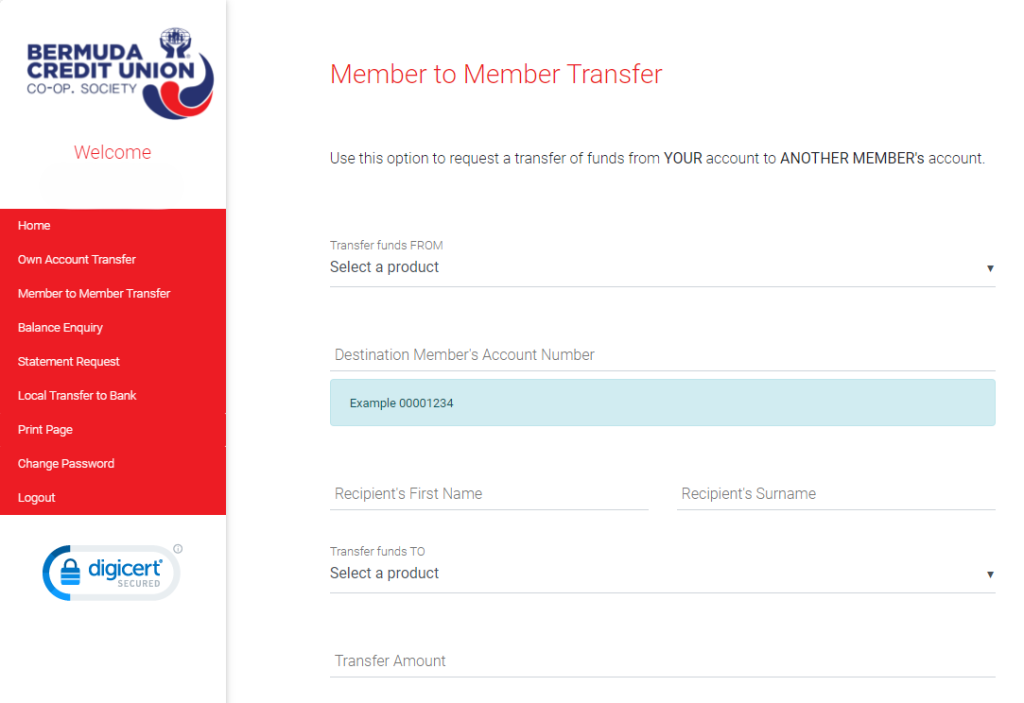

Save time and bank online with our online platform!

Nothing is impossible. We can help you achieve your goals!

When you set up online access at BCU, you can transfer funds between your accounts, download statements, and even send electronic transfers to accounts at other local banks.

Are you looking to transfer money from a local bank into your credit union account?

Nothing is impossible. We can help you achieve your goals!

Here’s a simple guide to help you securely transfer funds using the Credit Union’s account at Butterfield as an intermediary.

Follow these steps to ensure your money is deposited safely and efficiently, without having to leave the comfort of your home.

The Credit Union Difference.

Credit unions are not-for-profit, cooperative financial institutions created to serve their members’ financial needs. They are owned by their members and democratically governed by volunteer committees.

We offer similar products and services to that of a bank, with a more personal touch. We’re deeply focused on providing quality service to our members and the wider community. As a result, members generally see earnings as higher savings returns, access to loans and fewer fees.

Savings

A simple and convenient way to build savings, repay loans, or set some of your wages aside automatically.

Nothing is impossible. We can help you achieve your goals!

With Payroll Deductions, you can ask your employer to send a portion of your salary directly into your credit union account.